As the cryptocurrency market continues to capture attention worldwide, investors are keeping a keen eye on the performance of major digital assets and looking for the best crypto to buy now. In this analysis, we delve into the latest trends surrounding Bitcoin, Ether, and Solana, offering insights into their price movements and potential future directions.

Bitcoin Price Analysis

BTC/USDT daily chart. Source: TradingView

In a clear display of bullish strength, Bitcoin has maintained a solid uptrend, thwarting attempts by bears to halt its ascent. The recent resistance near $64,000 resulted in the formation of a pennant, but the bulls quickly reasserted their dominance by pushing the price above it on March 4. This breakout signals the commencement of the next leg of the uptrend, with potential targets set at the all-time high of $68,990 and a subsequent surge toward $76,000. Time is of the essence for bears, who must swiftly pull the price below $60,000 to have any chance of a comeback. Failure to do so could trigger stops for short-term traders, leading to a potential drop to the 20-day EMA at $56,250.

Ether Price Analysis

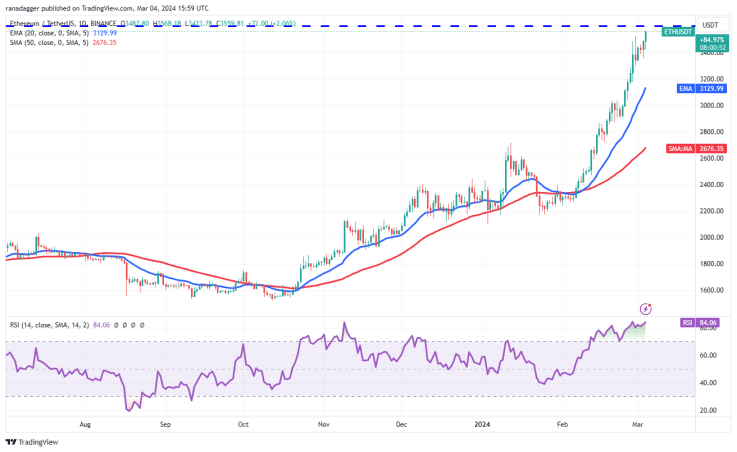

ETH/USDT daily chart. Source: TradingView

Ether experienced profit booking near $3,600 on February 29, but the lack of a substantial bearish pullback indicates strong buying interest in every minor dip. Bulls are now challenging the formidable barrier at $3,600, and a successful breach could set the stage for the next leg of the uptrend, propelling the ETH/USDT pair towards $4,000 and possibly $4,150. While the upsloping moving averages reflect bullish control, the RSI’s extended stay in the overbought zone raises the possibility of a short-term pullback. Immediate support lies at $3,300, followed by the 20-day EMA at $3,129.

Solana Price Analysis

SOL/USDT daily chart. Source: TradingView

Solana closed above the $126 resistance on March 1, but sustaining momentum has proven challenging, signaling a potential lack of demand at higher levels. The fate of the SOL/USDT pair hinges on its ability to stay above $126, paving the way for a resumption of the uptrend. A breach of the $138 level could see Solana surging to $143 and subsequently to $158. Conversely, a breakdown below $126 may lead to a retreat to the 20-day EMA at $116. Further weakness could expose the 50-day SMA at $104, suggesting a possible correction from the earlier breakout above $126.

As the cryptocurrency market continues to evolve, Bitcoin, Ether, and Solana showcase varying degrees of growth potential. While Bitcoin maintains its upward momentum, Ether faces short-term uncertainties amidst overbought conditions, and Solana grapples with sustaining bullish momentum. Investors should closely monitor these developments to make informed decisions in the dynamic crypto landscape.