Market observers suggest that Bitcoin’s current sideways price action could shift to a bullish trend in November, mirroring patterns from previous cycles. According to crypto analyst Miles Deutscher, historical data shows that Bitcoin typically experiences sideways price action in the period from Q2 to Q4 in pre-halving years. He points out that November 21 has historically been a key pivot point for Bitcoin’s price to start trending upward in the lead-up to the next halving event.

Historical Patterns

In the past, Bitcoin has exhibited similar sideways price action before turning bullish. For instance, in 2015, after six months of sideways trading, BTC’s price began to rise around November. A similar pattern occurred in 2019, with most of the year characterized by flat price movement before a late-year surge.

BTC price performance after each halving. Source: @milesdeutscher on Twitter

Bitcoin is currently trading approximately 60% below its all-time high, which aligns with historical trends from 2015 and 2019. Some analysts believe that a potential “dump” or price bottom could occur around November 10-15. The Bitcoin halving is expected to take place in late April or early May of the following year.

Bitcoin Halving in Just 200 Days 😳

Ever wondered where Bitcoin was 200 days before in the previous halvings?

In 2016, BTC was -65% below its ATH.

In 2019, BTC was -60% below its ATH.

In 2023, BTC is currently -60% below its ATH.

So, even if it seems like Bitcoin’s price… pic.twitter.com/H8dlWcM91y

— Mags (@thescalpingpro) October 9, 2023

Factors Influencing Price

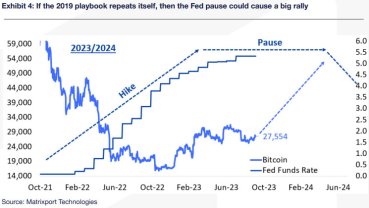

Markus Thielen, the head of research at Matrixport, suggests that Bitcoin’s price surge could be influenced by macroeconomic factors, similar to what happened in 2019 when the Federal Reserve paused its interest rate hikes, leading to a significant increase in Bitcoin prices.

Fed rate hikes and BTC price. Source: Matrixport

While various factors may influence Bitcoin’s price in the short term, most analysts and observers agree that the next major bull market is likely to occur in the year following a Bitcoin halving event.

As November approaches, market participants will be closely watching Bitcoin’s price action to see if historical patterns repeat themselves, potentially ushering in a bullish trend.