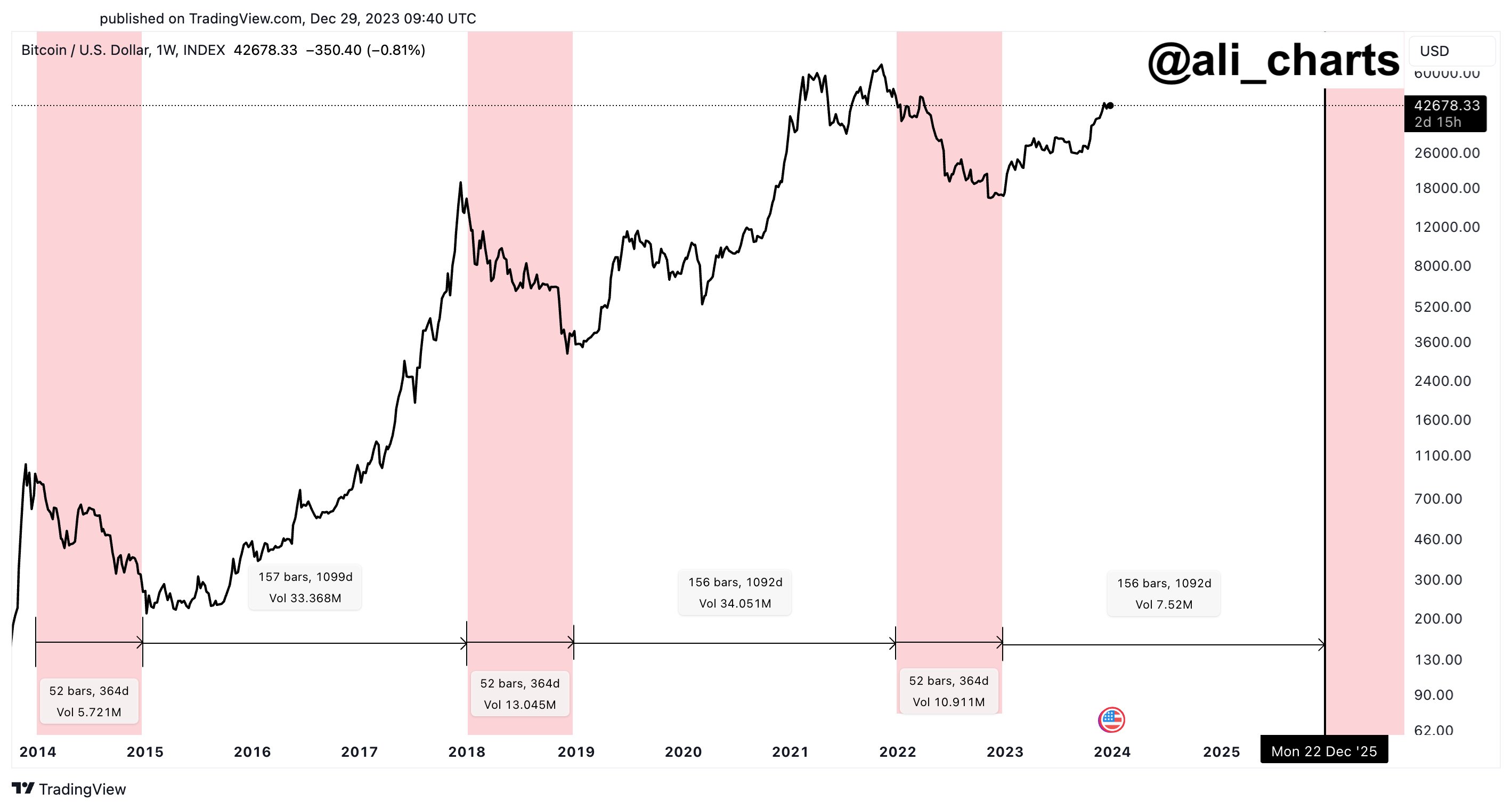

Bitcoin appears to have four-year cycles, separated into bull and bear cycles, based on historical chart patterns and trends. This corresponds, historically, to a bullish run of three years followed by a bearish correction of one year. The price of Bitcoin fell during the most recent bear market, from $68.8k in November 2021 to $16.4k in December 2022.

The Next Two Years Will See Another Bitcoin Bull Run

A Bitcoin cycle graphic that shows trends in BTC prices from 2014 to 2025 was released by well-known expert Ali Martinez. According to him, the four-year cycles that drive Bitcoin’s design are caused by halving events that occur every four years.

Events involving the halving of bitcoin typically result in a sharp increase in price. The four-year cycle consists of one year of bearish correction after three years of bullish tendencies. The price patterns of bitcoin have typically been comparable.

According to Martinez, Bitcoin has been in a bull market since January 2023 and may be in a bull market until December 2025. In 2023, the price of bitcoin increased 170% in spite of several litigation, regulatory obstacles, and more scrutiny.

The next Bitcoin halving is predicted by NiceHash’s countdown statistics to occur on April 20, 2024. The block reward for bitcoin will drop to 3.125 bitcoin from 6.25 bitcoin. In reaction to the impending halving event, the price of bitcoin has already begun to rise throughout the last two months.

The price of bitcoin has been fluctuating throughout the past 24 hours, currently hovering around $42,500. $41,424 is the 24-hour low and $42,462 is the 24-hour high. In addition, the trading volume has dropped by 7% during the past day, suggesting that traders are becoming less interested.

Additional factors driving the price surge of Bitcoin are the US Federal Reserve’s rate reduction and the US SEC’s approval of a spot Bitcoin ETF.