Introduction: Ethereum’s Security Backbone and the Innovation of Restaking

Ethereum, the second-largest blockchain network by market capitalization, has undergone numerous innovations in its quest for scalability, decentralization, and security. With the shift to Proof-of-Stake (PoS) via Ethereum 2.0, the ecosystem introduced validator-based consensus where ETH is staked to secure the network. However, 2023 and 2024 saw the emergence of a new trend: restaking. Spearheaded by EigenLayer, restaking introduces a paradigm shift in Ethereum’s security architecture by allowing stakers to opt-in to securing additional protocols using their already-staked ETH.

This article explores how EigenLayer is redefining Ethereum’s security model, the benefits and risks of restaking, its potential impact on decentralized finance (DeFi), and what the future might hold.

What is EigenLayer and How Does Restaking Work?

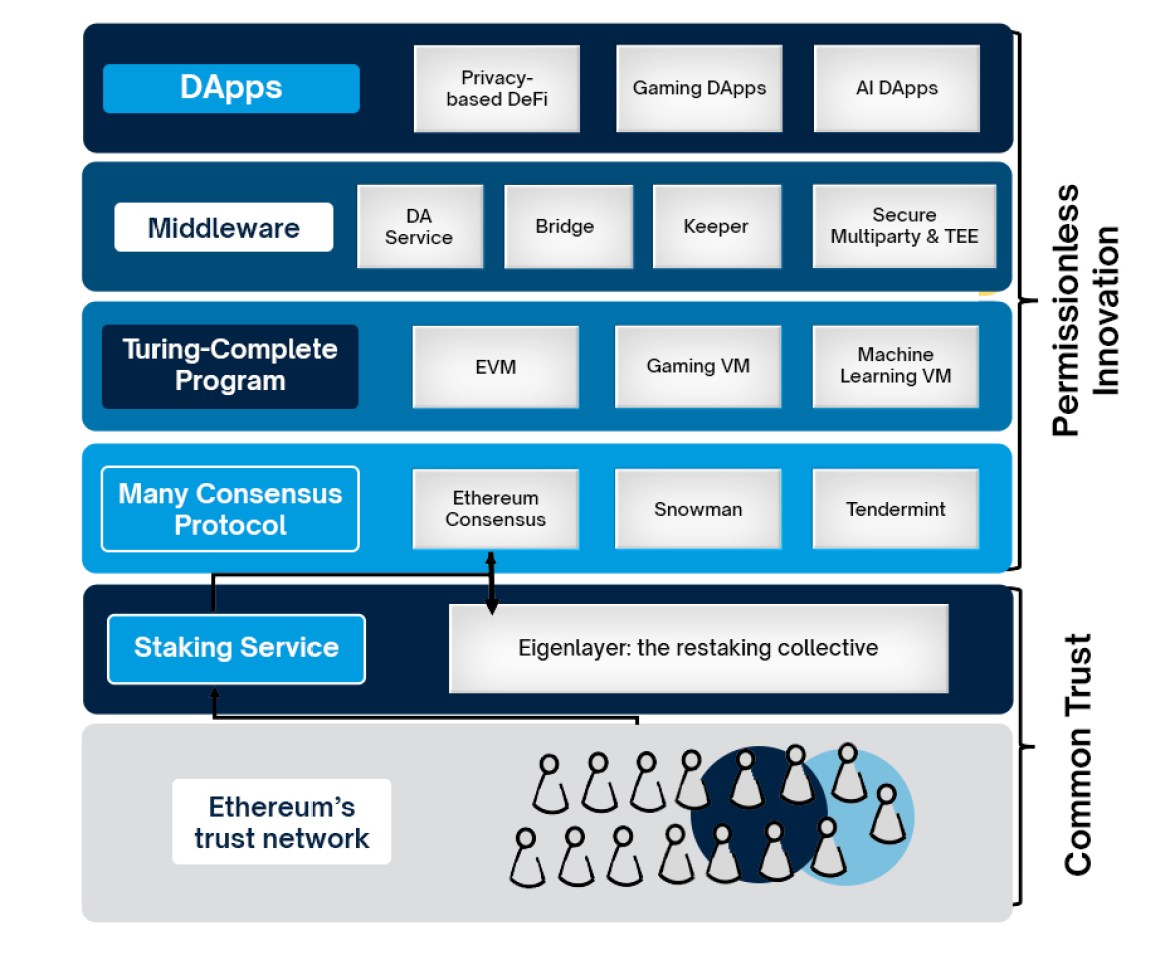

EigenLayer is a middleware protocol built on Ethereum that enables validators to restake their staked ETH or liquid staking tokens (like stETH from Lido or rETH from Rocket Pool) to secure third-party protocols. These protocols can include sidechains, data availability layers, oracles, and bridges.

Security-Composability

Traditionally, each new protocol would need to bootstrap its own validator or security system, which is both capital- and trust-intensive. EigenLayer solves this by tapping into the existing security of Ethereum, allowing protocols to “borrow” this trust.

The core idea is simple: stakers opt-in to provide additional security guarantees for external protocols, taking on more slashing risk in exchange for additional yield. EigenLayer thus acts as a marketplace for security, connecting demand (new protocols) with supply (Ethereum stakers).

Why Restaking Matters: Benefits for the Ecosystem

- Shared Security for Emerging Protocols

Restaking allows nascent projects to access Ethereum-grade security without the need to establish their own validator sets. This significantly reduces entry barriers and enhances security at launch. - Capital Efficiency for Stakers

Stakers can now earn multiple yields on the same ETH by restaking it across different protocols. This layered staking model increases capital efficiency and can potentially boost staking participation. - Accelerated Innovation

By reducing the security bootstrapping problem, EigenLayer allows developers to focus more on application-layer innovation rather than low-level infrastructure. - Enhanced Validator Utility

Restaking transforms validators into multipurpose security providers, broadening their economic role in the Ethereum ecosystem.

Risks and Criticisms of the Restaking Model

- Increased Slashing Risk

The most obvious downside is the compounded slashing risk. A validator misbehaving on a third-party protocol could lose their original ETH stake, making the ecosystem more fragile. - Complexity and Attack Surfaces

Restaking introduces more complexity into Ethereum’s validator ecosystem. The integration of multiple protocols increases the potential for bugs and attack vectors. - Economic Centralization

If only a few validators or staking providers dominate the restaking market, it could lead to centralization of power and influence over multiple protocols. - Regulatory Uncertainty

As restaking generates additional yield and complex cross-protocol interactions, it could attract regulatory scrutiny, especially concerning staking-as-a-service providers.

Impact on DeFi and Broader Ethereum Ecosystem

Restaking is poised to bring significant change to DeFi in several ways:

- New Yield Strategies: Protocols will start to build yield aggregators and structured products on top of restaking opportunities.

- Protocol Composability: With security as a service, DeFi protocols can become more modular, combining different layers secured via EigenLayer.

- De-Risking Infrastructure: Projects like bridges and oracles, traditionally vulnerable points, can now enhance trust by using Ethereum’s validator network via restaking.

- Incentive Alignment: Restaking ties the security of external protocols to Ethereum’s health, aligning incentives across multiple stakeholders in the ecosystem.

Future Outlook: Challenges and Opportunities Ahead

EigenLayer has successfully launched on the Ethereum mainnet in phased rollouts and is seeing growing participation. However, its long-term success will depend on a few key factors:

EigenLayer

- Robust Slashing Mechanisms: Protocols need clear and fair slashing conditions to avoid unnecessary loss of capital.

- Validator Education and Tooling: Simplifying restaking setup and providing robust tooling will be crucial for adoption.

- Regulatory Navigation: Developers and staking providers will need to stay ahead of legal developments in crypto staking and securities laws.

- Ecosystem Adoption: The real test will be in how many high-quality projects adopt EigenLayer for their security needs.

If executed correctly, EigenLayer could unlock a new wave of scalable, secure, and composable Web3 infrastructure.

Conclusion: A New Security Paradigm for Ethereum

EigenLayer’s restaking model introduces a fundamental innovation in blockchain security, transforming Ethereum’s staking infrastructure into a decentralized security marketplace. By allowing stakers to support multiple protocols and earn additional rewards, restaking increases capital efficiency and fosters broader ecosystem growth.

However, as with all innovations, it brings risks that need thoughtful design and governance. As EigenLayer evolves, it could redefine not just how Ethereum is secured, but how all of Web3 infrastructure scales securely and collaboratively.