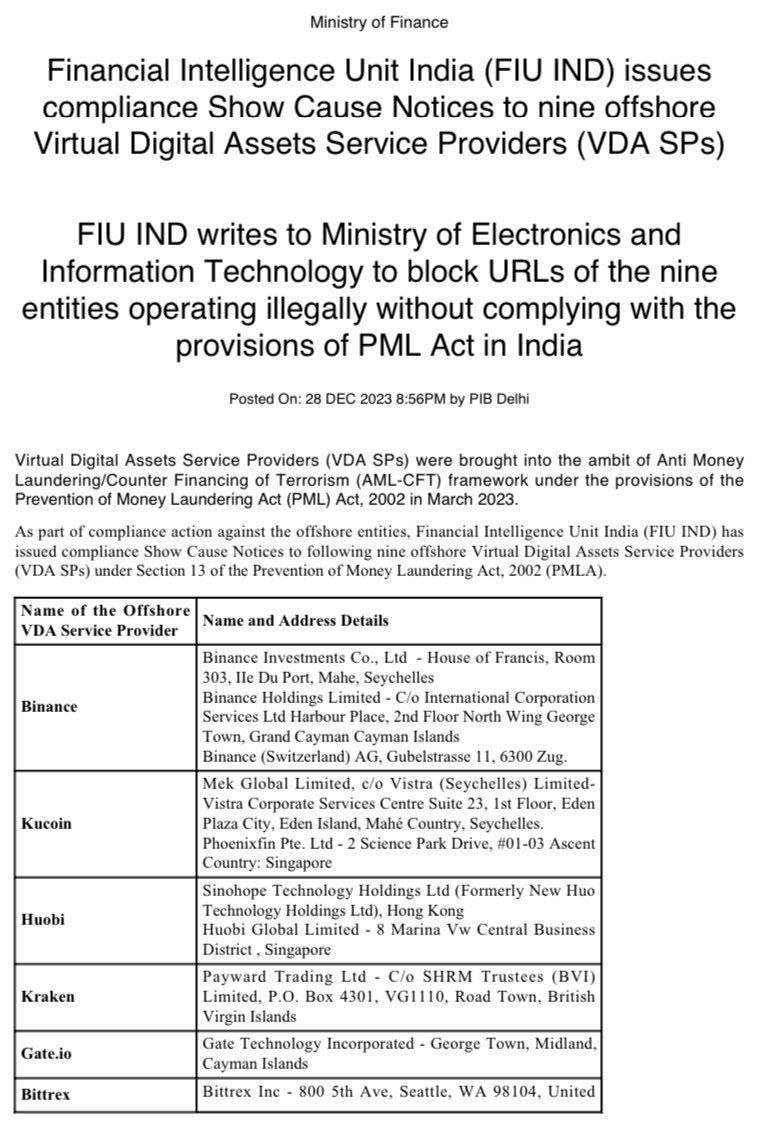

The Financial Intelligence Unit (FIU) has taken strong action against nine major cryptocurrency exchanges (CEXs): Binance, Kucoin, Gate, Huobi, Kraken, Bittrex, Bitstamp, MEXC, and Bitfinex. This action has caused a seismic shift in the cryptocurrency landscape of India. It has been determined that these exchanges, which together account for a sizeable amount of the volume of cryptocurrency trading worldwide, are not authorized to operate within the borders of India.

The FIU’s crackdown takes two key forms:

- Issuance of compliance Show Cause Notices: The FUI has sent Show Cause Notices to all nine of the CEXs, requesting explanations for their activities in India that do not adhere to the Prevention of Money Laundering Act (PML Act). These notifications effectively place the burden of proof on the exchanges to show that they are abiding with Indian laws, failing which they risk severe penalties or maybe being kicked out of the market altogether.

- Request for URL Blocking: The Ministry of Electronics and Information Technology (MeitY), which is overseeing the websites and mobile apps of these nine CEXs, has also received a letter from the FIU pleading with them to restrict Indian access to them. This “shadow ban” severely limits Indian users’ capacity to trade cryptocurrencies by preventing them from accessing these platforms directly.

India’s position on cryptocurrencies has been unclear for a while; in 2018, the Reserve Bank of India (RBI) banned banks from handling cryptocurrencies altogether. But in 2020, the Supreme Court overturned this prohibition, opening the door for a more cautious strategy. With its recent moves, the FBI has made it apparent that it intends to control the cryptocurrency industry and make sure that anti-money laundering and anti-terror funding laws are followed.

The implications of this move are far-reaching:

- Impact on Global Exchanges: Other CEXs operating in India should take note of this action as a severe warning. They now have to carefully assess their compliance standing and maybe modify their business practices to comply with the law.

- Uncertain Future for Indian Crypto Users: There are currently few trading choices available to Indian cryptocurrency aficionados, which may slow down market activity and prevent adoption. It is unclear how this will affect businesses and individual investors in the long run.

- Regulatory Landscape in Flux: The FIU’s decision is probably the start of a string of legal measures meant to exert more control over the Indian cryptocurrency market. It is critical to keep an eye on the MeitY’s response to the FIU’s request and any upcoming changes to policy.

India’s resolute action against significant CEXs is a watershed in the nation’s cryptocurrency history. Even while the full effect of this decision is still unknown, it is certain that India’s days of unrestricted cryptocurrency trading are coming to an end. Both domestic and foreign firms in the cryptocurrency market will need to adjust to the new normal in India as the regulatory landscape changes.