XRP showed fresh signs of resilience this week as large investors continued to accumulate the token, raising expectations of a sharp rally despite facing resistance at key price levels. Market analysts suggest that whale activity could fuel a breakout, with $4.20 emerging as the next significant target.

Whale Confidence in XRP Growth

The latest data from Santiment highlights that major investors have been steadily adding to their positions during recent pullbacks. Wallets holding between ten million and one hundred million XRP acquired over 120 million tokens in just three days, valued at about $340 million. These entities now hold roughly eight per cent of the token’s circulating supply.

Supply held by addresses holding between 10M and 100M XRP. Source: Santiment

This accumulation underlines a strong sense of confidence among whales, who see dips as opportunities rather than risks. Analysts believe such activity strengthens the case for an eventual breakout, particularly as the market enters the final quarter of the year.

Price Struggles at Resistance

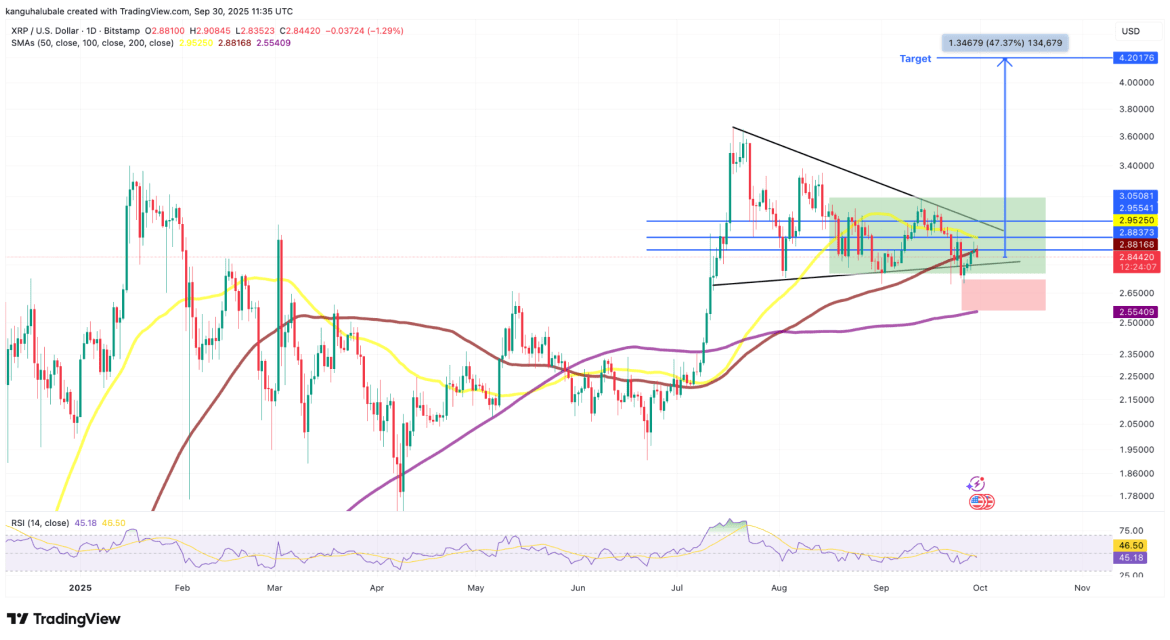

XRP rebounded from $2.70 support and climbed as much as 8.5 per cent to reach $2.92 on Monday, before retreating slightly as traders booked profits. Despite the short-term pullback, the token maintains a strong technical setup.

The rally faltered at $2.95, which aligns with the 50-day simple moving average. This level, along with the 100-day simple moving average at $2.88, has created a tough supply zone that XRP must conquer to sustain upward momentum.

Key Support Levels in Focus

On the downside, XRP has established support at $2.80, coinciding with the lower boundary of a symmetrical triangle pattern. A drop below this could bring the price towards the $2.69–$2.55 region, where the 200-day simple moving average offers the last major defence for bullish traders.

Analysts stress that maintaining these levels is critical for XRP to avoid a deeper correction. Holding above $2.88–$2.95 is equally vital to set the stage for a breakout.

Breakout Path to $4.20

A decisive move above $3.05, the upper trendline of the symmetrical triangle, would confirm a bullish breakout from consolidation. Technical projections suggest such a breakout could send XRP as high as $4.20, representing a 47 per cent surge from current levels.

XRP/USD daily chart. Source: TradingView

Market analyst Gordon described the potential move as “fast and aggressive,” predicting significant momentum once the token clears its consolidation zone.

Strong Outlook for Q4

Beyond the near-term targets, optimism is rising that XRP could be preparing for one of its strongest quarters on record. Some forecasts even point to highs near $15, though such gains would require sustained bullish momentum and wider market support.

For now, whale buying and the approaching quarterly close are keeping sentiment elevated. If XRP can hold critical support zones and pierce overhead resistance, the stage may be set for an explosive rally in the weeks ahead.